MorFund Financial Inc.

Institutional liquidity, larger commercial mortgages and unique asset financings.

Coast

to

Coast

Beginnings

Founded in 1996, MorFund is a commercial finance brokerage which provides institutional, individual and corporate property or business owners with innovative financial solutions.

Capacity

MorFund has reviewed and/or sold billions of dollars of commercial and residential mortgage pools on the secondary market on behalf of their institutional owners.

Liquidty

For lenders who are able to originate more loans than their balance sheet can support, MorFund establishes ongoing funding relationships with passive institutional investors who desire an on-going flow of business.

About Us

Our Services

Call to discuss your needs

1-604-618-3456

1-403-800-5310

Commercial Mortgages

Direct new loan originations are usually limited to loans in minimum amounts of $5 million or more.

Individual loans in amounts up to $140 million have been successfully completed and, in some cases, we are able to have the lender pay our fee. Although many of the loans we structure are conventional in nature, we have arranged unique, owner occupied first mortgages up to 100% of the property purchase price and at single digit interest rates.

Funding Relationships

Here our mandate is to create a private conduit of ongoing business between the loan originator (private lender, credit union or bank) and one or more passive (usually institutional or private hybrid) sources of capital.

We can establish A/B split sales, pari pasu funding opportunities, sales of portfolios and pools of mortgages.

Difficult Financings

In recent years, we have completed a variety of assignments to arrange financing for cannabis projects, hotels and entertainment facilities (including movie studios).

Typically we use institutional lenders but for smaller financings, private lenders and family offices have been very good.

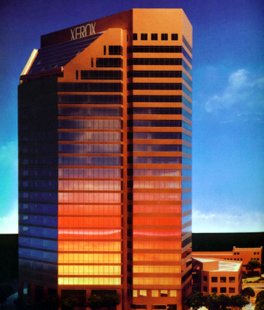

Photos

Double click to see full sized photos